The aftermath of Trump’s address to the nation on Wednesday night March 11, the stock market went into a free fall, losing 2,352.60 points, or 10%, the biggest single-day percentage drop since “Black Monday” in 1987. The Federal Reserve moved to offer a $1.5 trillion as an immediate bailout for Wall Streets and banks, which hit the market on Friday, March 13, resulting in a positive 1,985, point spike. Let’s be very clear, the Federal Reserve moved to offer a $1.5 trillion bailout without debate, legislation, or even a discussion of where this money is coming from, who benefits, and why is this the best approach to address the economic pain that will be faced by many.

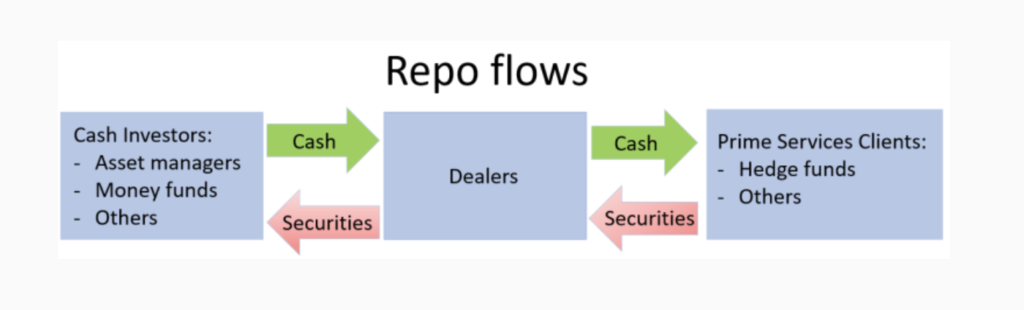

The Federal Reserve will funnel the money through an obscure tool known as the Repurchase Agreement (repo). This unknown to general public financial device “allows financial institutions that own lots of securities (e.g., banks, broker-dealers, hedge funds) to borrow cheaply, and in this case, the Fed will be infusing $1.5 trillion into this market. To put it in other words, the Federal Reserve will use the repurchase agreement market to offer short-term secured loans to Banks, broker-dealers, and hedge funds managers; then will turn around and repurchase it later at a higher price.

“The Desk will offer $500 billion in a three-month repo operation at 1:30 pm ET that will settle on March 13, 2020. Tomorrow, the Desk will further offer $500 billion in a three-month repo operation and $500 billion in a one-month repo operation for same-day settlement. Three-month and one-month repo operations for $500 billion will be offered on a weekly basis for the remainder of the monthly schedule. The Desk will continue to offer at least $175 billion in daily overnight repo operations and at least $45 billion in two-week term repo operations twice per week over this period.” [Source]

This repo is guaranteed, and free money is given to the obscenely rich and most powerful financial institutions in the country and rooted in the ill-conceived and many times discredit the trickle-down economic theory. The late Martin Luther King spoke of socialism for the rich and capitalism for the poor, which the Federal Reserve action on Thursday is but a small representation of it.

The Federal Reserve is not finished with further massive upward wealth redistribution and will take rate cut action on Wednesday, March 18, through the Federal Open Market Committee. What the big banks and investment houses are expecting from FOMC (the Federal Reserve body responsible for setting monetary policy) is a further reduction in the Federal Reserve Prime interest rate. The banks expect a sizeable reduction following a .50 basis point reduction just last week. Observers of the Federal Reserve are expecting another .50 or .75 rate cut on Wednesday, which would make money cheap and at a little cost to financial institutions with the hope that they would pass this to everyone else in the society.

If past behavior is indicative of future action, the banks and the financial institutions will take care of the wealthy and well-connected and move to punish the poor and the middle class. As the economy slows down and possibly end-up in a recession, the unemployment numbers will tick upward, jobs will be lost, mortgage and individual debt payments delayed, and the specter and stench of bankruptcies will be ever-present in towns and cities across the country. The financial industry response in the 2008-09 Great Recession was to kick some 12-14 million Americans from their homes, repossessed their assets then actioned them to the highest bidder. They caused the crisis in the first place with sub-prime mortgage, got bailed out by all of us then punished the poor and middle class and made more money in the process.

What we need is to have a moral and ethical clarity on this financial front. Socialism for the rich and capitalism for the poor under the rubric of trickle-down economics is a failed policy. It does not bring about balanced growth across all segments of society. The response to the COVID-19 virus should be an opportunity to address the real sources of inequality in our community and direct all assistance to those that will be most affected by it.

I would begin by sending $500 to $1000 to each taxpayer in the country as an immediate cash infusion into the pockets of Americans. This cash infusion is the easiest and fastest way to capitalize the financial institutions and cause the unlocking of the economy from the possible short-term freeze. I would put a 6-month immediate moratorium on bankruptcies related to delays in single home mortgage payments while incentivizing the banking industry to lower the rates to provide immediate relief to impacted homeowners. The discussion about erasing existing student debt should be moved into legislation, which will be a real $1.5 billion infusion into the economy and pockets of the middle class and poor. Other issues need to be considered but lastly, I would immediately put funds into small business loans and grants as they will be the hardest hit and least able to recover but are the most critical part of the economy for both employment and supply chain.